So, is finance consumer services a good career path? You must consider if a profession in financial consumer services is right for you before you get carried away by the attractive pay packages.

Knowing the answer to this may help you make the right decision regarding a profession in financial consumer services.

In the absence of these services, have you ever considered what their influence might be on the economy?

This article will demonstrate that financial consumer services are an excellent job choice for recent graduates. It will also introduce you to the many perks and career prospects available in this field.

So, let’s get started!

What Are Finance Consumer Services?

Finance consumer services are a company’s money-related services to its customers. The best example is a loan.

In common parlance, the term refers to financial debts incurred for purchasing goods and services of a general nature. For example, when a corporation or a retailer offers a variety of consumer financing choices to its customers, they can either use their resources or borrow money from a financial institution such as a loan provider or a bank. Additionally, this permits the consumers to acquire something they may not be able to afford or would prefer not to pay for with cash. This is a significant benefit.

The company sells goods, facilities, or loans to clients in money transfers in return for participation, expenditures, leasing, or another form of business.

What Are Some Examples of Finance Consumer Services?

As was just said, finance consumer services refer to those areas of the financial industry that serve regular customers. Some instances include:

- Savings and current account

- Credit cards

- Payment services

- Insurance

- Mortgages

- Investment products

Why Is It Important?

People will always borrow money for various reasons. These include purchasing a home or automobile, paying for a vacation or wedding, covering the costs of attending college, launching a company, or funding the introduction of a new product line.

People will always need to set aside a portion of their earnings to ensure that they have some money remaining at the end of each month and can take advantage of the opportunities presented to them in their younger years rather than postponing those experiences till later in life.

People don’t want to have just enough money saved up. Instead, they want more than enough money saved. Hence, they are financially secure and can retire comfortably whenever they want to!

People will choose to invest their money in stocks and bonds. That’s because this is one method in which they may safeguard themselves from the effects of inflation and market downturns. They will also invest by paying off their debt as quickly as possible to cut down on interest expenses and minimize their monthly payments. This will free up cash flow for other purposes, such as retirement savings or spending on luxury things, such as going on vacation.

In each of these situations, customers need the assistance of a consumer financial service that can advise them on the appropriate actions to take at the appropriate times and guide them in establishing a stable balance in their finances.

Is Finance Consumer Services a Good Career Path?

Yes.

It is an excellent employment opportunity that lets you connect directly with customers and get more acquainted with their requirements, views, and routines. Additional services in the field of finance are one example of this. Additionally, it makes it possible for you to be more sensitive to the market’s requirements.

One of the best ways to advance your career is to provide additional services since this will take you from an entry-level position to a professional one. Every single one of these people is a potential consumer. In addition, clients who come into your shop, company, or organization in search of a service or to make a transaction are considered external customers.

What Are the Jobs Available in Finance Consumer Services?

Work possibilities are many in the area of personal finance and budgeting. In the following paragraphs, we will present an overview of the diverse range of job opportunities that are accessible within this sector.

Personal Financial Advisor

Personal financial advisors provide services to a wide variety of clientele, including individuals and business tycoons.

Their principal responsibility is guiding clients on how they should approach matters pertaining to their taxes, investments, and other areas of their financial life.

In addition to this, they guide chances for financial investments that are both short-term and long-term in nature. Additionally, you can manage your portfolio with the help of the digital wallet provided by cex.io.

A personal financial adviser earns an average annual salary of $74,895, making it one of the highest-paid positions in the financial consumer services industry.

Accountant

An accountant is a trained professional who, on behalf of an organization, keeps detailed records of the financial transactions that have taken place and give feedback on that company’s business activities.

A public accountant is responsible for various tasks, including evaluating the meaning of financial statements and ensuring that the accounting records are correct.

Accountants make a minimum yearly salary of $52,471.

Financial Manager

Most of the time, it is up to a company’s financial managers to keep an eye on the general health of the company’s finances and make any necessary contributions to ensure its continued existence.

They supervise essential activities such as monitoring cash flow, determining whether or not a company is successful, overseeing expenditure management, and producing accurate financial information.

Jobs in the financial business such as financial analysts, auditors, consultants, financial controllers, and financial planners have responsibilities analogous to those of financial managers.

A financial manager makes an annual income of $74,659, making it one of the highest paid occupations in the finance consumer services industry.

Compliance Analyst

Compliance analysts contribute to designing secure systems to facilitate the delivery and ongoing maintenance of compliant infrastructure.

In addition, compliance analysts assist firms in adhering to all standards, enabling the company to better prepare for audits.

Overall, a compliance analyst’s annual salary is usually about $77,456.

Private Equity Associate

A private equity associate is one of the multiple business executives working in investment banking to find potential investors.

In addition, they assist with acquired investments and carry out due diligence with the customers that an investment bank already has.

They are beneficial through the process of a contract, from the beginning when it is being drafted to the finish when it is being formalized.

According to the statistics we looked up, a private equity associate has an average annual salary of $97,432.

Loan Officer

A person hired by a financial institution such as a bank, credit union, or another form of a financial institution to advise prospective borrowers on the loan application process is a loan officer.

In addition, other occupations in this area that are equivalent include those of loan collectors, loan credit risk analysts, and a great number of others.

A loan officer makes a salary that is, on average, $48,789 a year, making it one of the best-paying positions in the finance consumer services industry.

Chief Financial Officer(CFO)

The top manager in a company who supervises all of the company’s financial activities is known as the chief financial officer, or CFO for short.

This position is very significant and challenging to fill because the bulk of the financial decisions in a business or organization are finalized in the office of the chief financial officer.

The Chief Financial Officer receives a compensation package that is on the higher end of the pay scale. The annual pay of a Chief Financial Officer is typically in the range of $139,452 on average.

Financial Software Engineer

A person who develops, updates, and maintains software programs for use in the banking and financial sectors is a financial software developer.

Additionally, they work with various companies to build software for various purposes, such as software for financial education and software for processing debit and credit cards.

These organizations vary from huge financial institutions and banks to corporations of a more manageable size.

The yearly income of a financial software engineer comes out to an average of $106,345, making this profession one of the highest-paid positions in the finance consumer services industry.

Compliance Officer

As a compliance officer, you are responsible for ensuring that the company you work for conforms to the external regulatory requirements and the internal rules that the company has developed.

You are responsible for keeping an eye on your employer to ensure that they abide by the guidelines set out by the firm.

You will also have the opportunity to advance in your career if you choose this route, as you can work your way up from the compliance officer to the chief compliance officer position.

According to industry standards, a chief compliance officer makes a minimum salary of $121,698 annually.

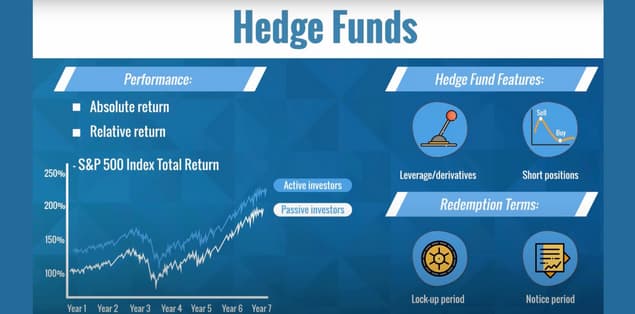

Hedge Fund Managers

A hedge fund manager is similar to an investment banker in that they execute activities similar to their job. They often find work in hedge funds, where the major responsibility of their position is to keep an eye on investment accounts.

In addition, they aid investors in managing their investments by measuring liquidity in the same way as an investment. For example, the management of a hedge fund often receives compensation at an exceptionally high rate.

A hedge fund manager earns an average annual income of $145,768. This position is considered one of the highest-paid in the financial and consumer services industries.

Investment Banker

Investment bankers are responsible for a wide range of tasks. One of the most important of which is the management of the investment portfolios of corporations and governmental entities that have stakes in various businesses.

These professionals lead customers step-by-step through the procedures of accumulating cash and making investments that benefit the company’s efforts to generate more revenue.

It is generally agreed upon that a yearly income of $61,929 is the national average pay.

What Are the Pros and Cons of a Career in Finance Consumer Services?

The sector of the economy that deals with financial services have been one that prioritizes expansion for the better part of three decades. A significant portion of this expansion may be attributed to the ongoing trend toward the globalization of markets. As a result of this globalization trend, investors in practically all nations now have access to an unprecedented number of banking resources and investment opportunities. The financial crisis that started in 2008 placed a temporary dent in the expansion of the financial services sector. However, the need for financial professionals will revive as the economic cycle bottoms out and starts to turn back up as the economic cycle bottoms out and begins to turn back up.

Below are some of the pros and cons of the finance consumer services industry:

Pros

The Possibility of a Significant Income

There are a variety of jobs available within the financial services business, many of which have the potential to earn six figures. For example, many financial service employees sometimes have the opportunity to make much more than the average income. According to the data provided by the Bureau of Labor Statistics of the United States of America in 2022, the median annual income for sales agents and brokers working in the financial services business was $64,770. Also, according to the data provided by the BLS, in 2022, the median compensation for financial managers was a respectable $153,460.

Consistent Business Hours And a Pleasant Working Environment

Even while certain floor brokers and financial agents operate in the trading pits of some exchanges, the great majority of personnel in the financial services business sit at desks in climate-controlled offices in cities all across the United States. Most financial service employees also have the luxury of working normal business hours (the stock and bond markets in the United States are open from 8:30 a.m. to 3 p.m. central time) and are compensated for every country’s official holidays.

Cons

Pressure-Packed Situations

Most jobs in the financial services business are very stressful and include working in a fast-paced environment. Companies evaluate the performance of financial analysts and traders frequently, and a run of incorrect predictions may affect one’s salary and possibly result in the loss of one’s employment. A sales agent or broker’s revenue comes from making sales, including convincing customers to create accounts, engage in trades, or purchase investment goods.

According to the website Gen Twenty, geared toward people in their twenties and thirties, many companies require their employees to meet sales quotas to keep their jobs. This can cause employees to experience great stress as they try to meet their quotas and maintain employment.

It Is an Industry Characterized By Instability

The job security situation is unstable for those who work in the financial services business, which is another disadvantage of this line of employment. The industry of financial services tends to experience cycles of growth and decline. Financial institutions like banks and brokerages tend to go on recruiting sprees when the economy is doing well, and the markets are doing well.

However, when the economy is down, they end up laying off their workforce. Top financial analysts and sales agents are less likely to be affected by mass layoffs. However, only a few financial service employees are safe in a severe economic crisis.

Final Words

Suppose you want to work in the finance consumer service sector and have outstanding credentials. In that case, you could be the ideal candidate for the positions these companies are looking to fill. Hence, there are various career possibilities available in this sector so that you can discover something a good fit for your abilities and interests.

An accountant is one of the most common jobs in the customer service industry, followed closely by an account executive and investment bankers. In addition, if you have a solid academic background, obtaining one of these highly desired occupations should not have been difficult for you. Therefore, if you are interested in beginning a career in customer service, you should brush up on your skills and search for the job that best suits your interests.